Financial institutions, governments, investors, and tech developers around the world are exploring Decentralized Finance (DeFi) as the next game-changing technology. The first wave of DeFi focused on opening a world to transact peer to peer in a scalable way. Today, Institutional DeFi, the second wave of development, is working to overcome regulatory hurdles and empower peer-to-institution transactions.

The world of traditional finance can see great promise in DeFi. Decentralization can facilitate streamlined foreign exchanges, digital transfer of real-world assets, and tokenization of classic financial holdings like equities and bonds. But some fundamental elements of DeFi, including the decentralization, run far beyond the comfort zone of standard financial practices.

In this guide, we’ll cover the value, design, and future of Institutional DeFi. We’ll also go over use cases of companies at the forefront of integrating decentralized finance into their mission.

We will see how financial institutions and investors can use DeFi protocols to massively reduce overhead costs and create new business ventures. For financial organizations that can adapt their business models to this technology, the benefits of Institutional DeFi can be huge.

The Value of Institutional DeFi

DeFi offers solutions to many common issues pervading traditional financial institutions. At present, TradFi is burdened by having multiple ledgers recording real-world assets. Without a cohesive database, TradFi relies on intermediaries to translate transactions between siloed ledgers. Then, after both parties can check their books to finalize the settlement, there’s a follow-up with the intermediaries.

DeFi can run in a more straightforward manner. With DeFi, multiple parties are able to simultaneously view the same information by having combined networks and ledgers stored on the blockchain. There’s no need for follow-up or reconciliation (or the overhead that comes with it) because all parties have access to the same secure, immutable, and time-stamped record of transactions.

Contracts also become simpler with DeFi. Smart contracts consist of self-executing coding and are built with complete transparency. Once both parties edit and agree to a contract, they sign. This fully automated, digital contract system enforces compliance requirements and limits disputes between parties.

And DeFi offers many other benefits besides its operational efficiency. While collaborating across multiple services, asset classes, and markets, it’s allowing users to maintain control of their assets. With greater interoperability comes a greater liquidity pool and potentially better integration across the global financial industry in the future.

But, for now, let’s look at some specific DeFi benefits and financial services that can benefit both small-scale users and large-scale institutions:

DEX and digital asset trading

Decentralized exchanges (DEXs) allow for crypto assets to be exchanged without a central authority or third party. By having transactions run from peer-to-peer, users can maintain full control of their assets as they buy and sell them.

DEX platforms offer greater network capacity, reduced fees, insurance of assets, and lower latency. This, combined with digital asset trading’s global scalability, make DEXs a viable and exciting realm for large-scale institutional DeFi development.

With an internet connection and DeFi wallets, users from all over the world can access Uniswap, Sushiswap, and other DEXs. On Hedera, three DEXs to which traders can buy and sell digital assets are SaucerSwap, HeliSwap, and BubbleSwap.

Liquidity pools

Buyers and sellers can interact directly through decentralized liquidity pools, whether through a DEX or a lending protocol. Often, these peer-to-peer pools are built on the same chain or conjoined with chain bridges to make them interoperable. This allows for more investors to dip into the pool.

Exchanges are governed by smart contracts, and institutional investors can trade, deposit, or borrow digital currency. In some liquidity mining protocols, users receive native tokens as rewards while maintaining liquidity.

AMMs

One of the most exciting developments helping pave the way for the institutional growth in DeFi are Automated Market Makers (AMMs). They offer a new means of price discovery, using self-executing smart contracts. With a transparent formula for constant-function market makers, the AMM uses supply and demand to provide quotes for exchanging one fungible cryptocurrency for another. If you want to trade one coin for another, you automatically know how much you will receive without waiting for a quote, buyer, or seller.

Yield farming

Yield farming protocols are another DeFi tool for optimizing earnings from investments. Combining staking, lending, and borrowing, protocols like Yearn and Vesper allow users to stake multiply in different non-custodial DeFi protocols. They are two yield farming programs that automatically find and move assets to the highest yielding programs for their liquidity providers. Without this automated process, yield farmers must repeatedly search for the highest returns on fixed or variable interest rates and manually move their assets.

Lending protocols

DeFi lending protocols allow users to borrow funds, putting up digital assets such as cryptocurrencies and tokenized assets as collateral. They also allow lenders to add assets to liquidity pools for much higher APYs than found in traditional finance. All operate on a peer-to-peer network. The users are able to lend assets that they don’t need in the immediate future.

Aave is one of the most popular peer-to-peer lending platforms. In 2021, Aave released Aave Pro, which creates “Know Your Customer” lending pools separate from Aave’s regular lending pools. Aave Pro is a lending protocol made for institutional investors, designed to be compliant with institutional regulatory requirements.

Institutional DeFi Design

There are many reasons for TradFi to turn toward DeFi systems. DeFi can expedite many processes that slow down traditional financial institutions. However, financial institutions still must decide what their goals are, what services they want to offer, and what they want to achieve. Only then can they decide what DeFi design is right for them.

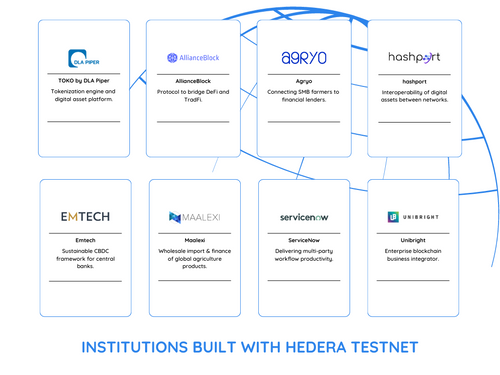

Not all DeFi protocols are designed to be compatible with mainstream finance functions. Hedera is an exception. With secure and efficient consensus and execution layers, Hedera’s Testnet service offers TradFi organizations safe and seamless means to branch into DeFi.

The traditional finance industry has had centuries to develop robust security standards, and decades to adjust to the age of the Internet. DeFi, the next wave of finance development, needs to develop equally rigorous standards for financial security in a fraction of the time.

Already, traditional market standards like Know Your Customer and trade surveillance are being translated into DeFi. And as more traditional enterprises innovate, DeFi’s safeguards continue to develop.

So far, the Ethereum Network has been the dominant platform for DeFi. But there are other platforms, like Hedera, offering new possibilities.

At Hedera, our hashgraph consensus algorithm offers fast, fair, and secure tokenization and transfer of fungible and non-fungible assets on the Hedera public network. Hedera’s unique functionalities of consensus timestamping, fair transaction ordering, and fast finality make it the public DLT of choice for Enterprise supply chain applications.

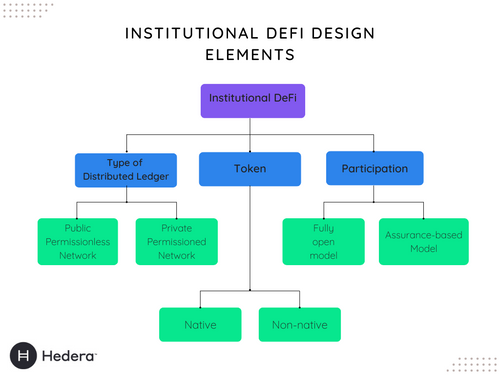

There are three primary design elements that Institutional DeFi applications have to decide on, depending on what services they’d like to offer and what their goals are.

Type of distributed ledger technology

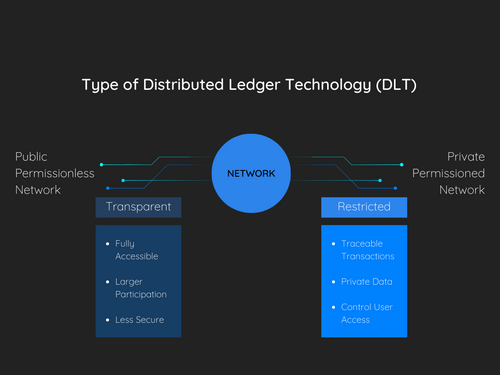

When developing an enterprise’s DeFi application, the first decision is what type of Distributed Ledger Technology it will be best to build it on. There is no one-size-fits-all answer, it depends entirely on the organization’s DeFi mission.

In the case of someone looking to research and experiment and access a wide array of users, a public permissionless network could be best. Or, if they’re looking for a more closed container of secure development, a private permissioned option could suit them.

The type of blockchain used defines what information is visible, and to whom. Ethereum and Polygon are two popular public permissionless networks. As “permissionless,” they are fully accessible and can draw in larger participation. Public permissionless networks often have good interoperability with other DeFi protocols that are also on permissionless systems. Technology and development on these blockchains are often very composable but also less secure unless adequate safety measures are imposed.

On the other hand, public permissioned networks control user access. The data visibility of system transactions is restricted, and it’s easier to trace transactions and levy checks and balances. For institutional developers, a public permissionless blockchain model could be tailored to meet their needs for security and scalability. Hedera works to bring decentralized ordering and interoperability to business applications running on a public permissioned blockchain framework.

Hedera, though it’s compatible with the Ethereum network, is distinct from these methods because it’s not a blockchain. Instead, Hedera is a fully open source, proof-of-stake, public network and governing body for building and deploying decentralized applications.

Hedera uses a hashgraph consensus algorithm compliant with the CNSA Suite security standard, the same required for protecting U.S. government Top Secret information. For interested developers, Hedera’s Testnet service is a great means to explore, design, and build on a secure public network.

Token

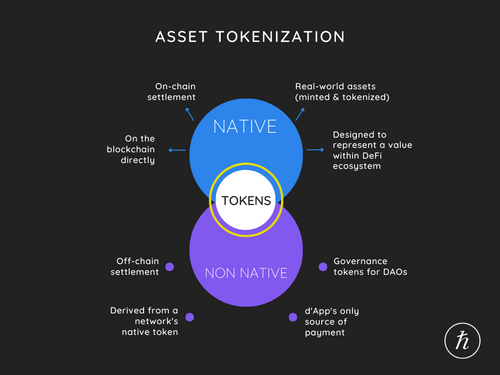

Asset tokenization is a key part of DeFi development, and one of the many features that make DeFi such an appealing arena for many traditional institutions. There two types of tokens to choose from are native and non-native. Token design defines how tokens are issued, standardized, exchanged, and settled.

In both cases, the tokens are free to interact with embedded smart contracts. This allows for transactions and asset servicing to be handled through a DeFi protocol’s automatic execution. But there are still areas of legal ambiguity around linking the token to its conjoined real-world asset for both native and non-native tokens.

With native tokens, these real-world assets are minted and tokenized on the blockchain directly. They’re foundational to the decentralized network and are designed to represent a value within that DeFi ecosystem. ETH, for example, is the native coin to the Ethereum network.

Non-native tokens are usually derived from a network’s native token. They can be used as governance tokens for decentralized autonomous organizations (DAOs), or as a dApp’s only source of payment. They’re managed primarily using off-chain processes.

Settlements can occur both on-chain and off-chain. However, there are legal restrictions that define whether a settlement can be legally recognized as a finalized ownership ledger. To discern the possibilities and limitations of this, there needs to be some knowledge about the applicable commercial law and contractual regulation relevant to the transaction. As blockchain exchanges become more popularized, the hope is that the antiquated ledger systems can be entirely replaced.

Off-chain settlement is where an off-chain ledger is updated to log the change of token ownership. This is needed when there is a token transfer that isn’t officially recognized as a transfer of a real-world asset. On-chain settlements are when the finalized ownership is reported and accepted as true directly from the decentralized ledger.

Participation

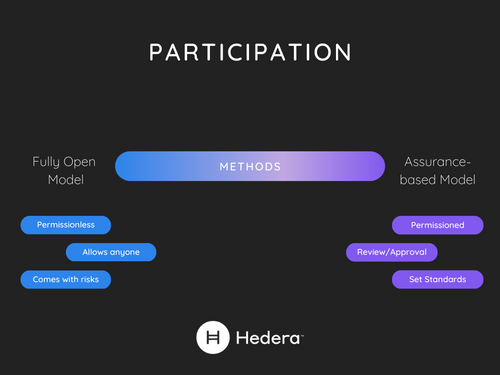

How the dApp encourages or allows participation is another formative choice for the institution. There is a wide spectrum of approaches, with a fully open model on one end, and an assurance-based model on the other. Let’s get into the two methods.

In a fully open model, the dApp allows anyone to engage, develop, and deploy smart contracts and code without barriers to getting involved. This creates a great environment for innovation and competition, but because there are no vetting measures before protocols are deployed, it comes with risk.

An assurance-based model has review and approval mechanisms enacted to make sure that their standards are met before code is deployed. These can be tailored to meet nuanced company standards or broad industry regulatory requirements. Either the developers themselves can be vetted, or the protocol can have specific code checks required.

Of course, code audits and checks and balances can be instituted to tighten up a fully open model. And there can be more lenient variants of the assurance-based model. By no means is there a strict dichotomy between the two systems.

The Future of Institutional DeFi

Change is coming. Who is driving it? Various parties have different views on and goals for Institutional DeFi.

-

Financial institutions: Banks and brokerage firms

-

DeFi companies: Tech companies, developers, and advocates

-

Users: Including investors and corporations looking to borrow and lend

-

Regulators: Think national governments, central banks and international agencies

Ideally, some or all of them will work together to find solutions to bring the best possible future for DeFi.

Since 2021, many new DeFi tools have been launched to focus on institution development. One newer platform to note is MetaMask Institutional, a digital currency wallet designed for enterprise-scale use. It connects institutions with crypto funds while offering dApp access and custody solutions. Anchorage Digital developed a network between five digital asset trading platforms, assigning institutional client funds into vaulted and regulated assets.

With new tools, products, services, and infrastructure all working to serve institutional needs, development is well underway for the wide-scale integration of DeFi into TradFi. The benefits of DeFi, borderless transfers, instantaneous data exchange, and 24/7 liquidity, are well worth overcoming the hurdles it faces.

Let’s look at some of the specific challenges in DeFi and what is being done.

Security

Data transparency is a vital but complex feature of DeFi. Market participants can decide to have all transactions publicly visible, or allow only relevant parties to see their specific transactional data. There are different techniques for this, like function-level access management, zero-knowledge proofs, or selectively sharing viewing keys for encrypted data.

Data security is critical to prevent market manipulation like maximal extractable value (MEV) where miners deliberately affect market prices for their benefit. Privacy loss is also a greater risk with blockchain platforms because data is stored immutably and permanently on the ledger.

There are many tactics to lessen the inherent risk of decentralized finance, depending on the scale of the institution and the complexity of its needs. Safe storage of private keys, key recovery options, and multi-signature requirements can all set good parameters around use. Limits can also be placed on the number of transactions or transaction size, and different wallet addresses can be whitelisted.

Regulation

Small- and mid-cap Crypto Funds have bloomed in DeFi, in part because their size often means lesser regulatory oversight. Larger enterprises face more stringent reporting requirements, regulatory monitoring, and compliance expectations

In traditional finance, there are baseline regulatory requirements like Anti Money Laundering (AML), Know Your Business (KYB), and Combatting the Finance of Terrorism (CFT). In Europe, Asia, and the US, trading with sanctioned or nefarious counterparties can lead to incarceration. Regulatory oversight is crucial to maintain accountability for these regulations. But that turns the decentralization and pseudonymity of DeFi into a vulnerability.

These challenges are being met, and even governmental agencies themselves are some of the entrepreneurs. Central Bank Digital Currencies (CBDC) are digital currencies regulated by a country’s monetary authority, usually deployed on permissioned blockchain frameworks. A 2021 survey found that 90% of surveyed central banks were investigating CBDC projects, while 26% were actively piloting projects.

To meet regulatory compliance, stablecoins and cryptocurrencies require KYC configurations at the account level. Hedera accommodates this, while enabling token issuers to freeze token supply management, transfers, and more. The Hedera Consensus Service preserves privacy while providing transparency and trust for national and international payments.

Stabilizing costs

Some of the undermining issues of decentralized transfers are long processing times and volatile gas fees. In moments of high traffic or in moments of ETH volatility, Ethereum’s gas fees can skyrocket. Gas fees are effectively like the cost of admission to add a transaction data point onto a blockchain; when lots of parties want admission, gas fees have a major uptick. On May 1, 2022, Ethereum gas fees rose nearly nine times what it had been the day before.

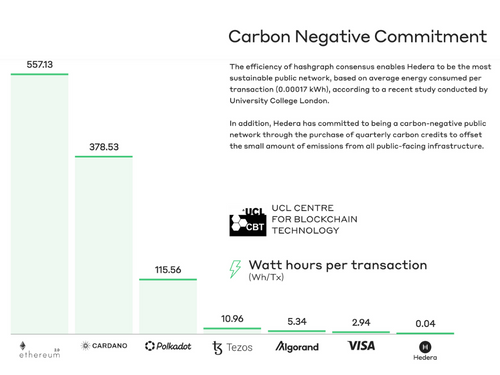

Meanwhile, Hedera’s Hashgraph consensus is fast and efficient, enabling low and predictable transaction fees for issued tokens. It costs less than 1¢ USD to transfer any sum of a tokenized asset on Hedera.

Transaction capacity

Both the public and private sectors are exploring tokenized assets and payment systems. By the end of August 2022, China’s digital yuan (e-CNY) reached $13.9 billion in transaction volume.

Broadridge Financial Solutions’ distributed ledger platform, Repo, reached a daily transaction volume of $35 billion using tokenized government bonds just weeks after they launched. As these transactions multiply, networks need to be able to handle larger transaction loads.

At Hedera, the underlying hashgraph consensus allows for thousands of transactions per second. The large bandwidth that Institutional DeFi demands is Hedera’s baseline, offering a time-stamped and tamper-proof final ledger within seconds. Even a fast home internet connection could enable a hashgraph node to be fast enough to handle transaction volume equal to that of the entire global VISA card network. Start building decentralized applications today with a HederaTestnet developer portal profile.